Focuses

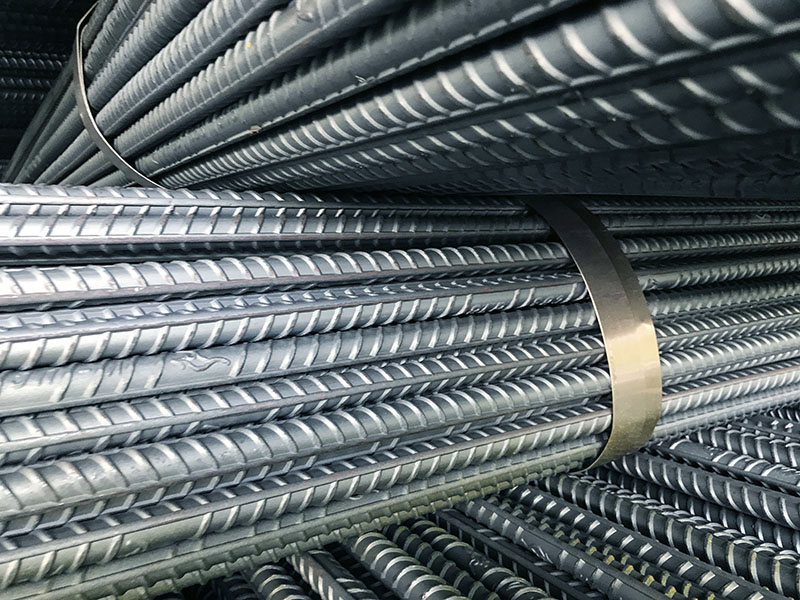

CONSTRUCTION STEEL PRICES ARE ON THE SIGNIFICANT DECREASE BECAUSE OF U.S TARIFFS

On Monday (02/06), futures prices of construction steel at Shanghai has declined after the data demonstrated that growth rate of many Chinese factories begun dwelling as the United States imposes tariffs on Chinese goods worth USD 34 billion and will come into effect this week. China’s economic growth rate has slowed down and the high tax risk causes the significant decrease in iron ore demands. “We suppose steel demand in China will fall within the next one and a half year. Steel exports can not grow in the context of trade war”, Guiqui Zhuo analyst said.

Prices of construction steel delivering in October fall approximately 0.9% to 3,751 yuan / ton. Prices of iron ore delivering in September on the Dalian Commodities Exchange fall 1,9% to 463 yuan/ton. Iron ore spot prices fall nearly 11 percent to $ 65.02/ton in the beginning of the year, the lowest level in nearly a month. Prices of coking coal increase 1.9% to 1,166.5 yuan / ton. Coke coal futures prices fall 2.5 percent to 2,025 yuan a ton.

Source: Vietnambiz

VIETNAMESE ENTERPRISES ARE FACING ANTI-DUMPING INVESTIGATIONS INTO STEEL PRODUCTS

On June 12 2018, several of US companies filed a request for investigating and applying anti-dumping measures on Vietnamese steel to the US Department of Commerce (DOC). This product was filed is corrosion-resistant steel. Plaintiffs supposed that Vietnam imported hot rolled steel products from Taiwan, Korea to produce and sell to the US at low prices.

Plaintiffs claimed that after the United States had conducted anti-dumping and anti-subsidy investigations in 2015, imports of CORE (corrosion-resistant carbon steel) and CRS (cold-rolled steel) from Korea and Taiwan declined. Meanwhile, imports from Vietnam have increased rapidly. In addition, Plaintiffs alleged that Vietnam imported hot rolled coils from Taiwan and Korea for production. This production has no significant transformation in the product.

According to US regulations, the DOC will consider and decide whether to initiate an investigation within 45 days of receiving the request. It is expected on July 27, 2018 and to issue a final decision within 300 days of initiating. The Ministry of Industry and Trade (MOIT) recommends that related enterprises involve all and cooperate with the investigating authorities to ensure positive results in this case.

VIETNAMESE STEEL FACED MANY COMMERCIAL LAWSUITS

In recent years, steel products of our country are facing many commercial lawsuits. Recently, Indonesia has imposed anti-dumping duties on color coated steel sheet imported from our country at rate of 12.1% to 28.49%. By the end of 2017, the steel industry in Vietnam has been subject to more than 30 lawsuits related to the dumping.

It is concerned that this matter will cause difficulties for the export of Vietnamese enterprises. Therefore, Vietnam Steel Association (VSA) supposed that with the high demand of this market right now, domestic corrugated steel enterprises still have opportunities for competition.

VSA’s demand for steel consumption is still on the rise. Consequently, the steel consumption indicator can still reach a positive growth and exceed 90 million tons in 2019. This is a good signal for businesses to promote exports to this market.

In Southeast Asian countries, steel consumption of Vietnam and Indonesia account for 60%, the United States account for 12%. In the export of cold rolled steel, galvanized steel, Vietnam is the country having the strongest production ability. In Indonesia, Vietnam may account for a large import quantity in this market.

So what is the solution?

In this case of tax imposition, businesses have been prepared previously. Manufacturers have expanded the market quite a lot such as Europe, United States … not to remain passive as before. However, VSA also reminded the business to solve this problem absolutely:

– Enhance the competitiveness. It is essential to be self-control in material and no longer depends on China.

– Try to close from production to consumption and improve service quality.

CHINESE ALUMINUM OUTPUT INCREASED BY 1.5% IN MAY

According to data compiled by the National Bureau of Statistics of China, aluminum output in May raised by 1.5 percent up to 2.79 million tons in comparison with the same period last year.

China consumed 90,000 tons of metal last month. Aluminum prices in Shanghai raised by 0.8 percent in May and before increasing by 4.8 percent in April after the punishment of United States for Russian manufacturers. Metals are on the increase about 5.6% in Shanghai this quarter. The impact on London’s aluminum prices is even more obvious, causing Chinese aluminum manufacturers to export more metals in May.

In the first five months of this year, China produced 13.6 million tons, increase by 1.4% compared with the same period last year. Manufacture 10 color metals – including copper, aluminum, lead, zinc and nickel – raised by 4.3 percent up to 4.55 million tons against last year. Annual output increase by 3.2 percent up to 22.2 million tons, the data show. The others are tin, antimony, mercury, magnesium and titanium.

CHINA’S ALUMINUM EXPORTS RISE DESPITE ENCOUNTERING THE TRADE BARRIERS

China’s aluminum exports have risen to the highest level in haft of the year. Meanwhile, steel exports were also the highest since July 2017 owing to global market recovery.

China is the largest steel and aluminum manufacturer in the world. Both products are subject to the 25% and 10% tariffs imposed by the United States from March 23. China Customs General Administration said that unprocessed aluminum exports reached 485,000 tons last month. That is the second highest figure only behind of 542,700 tons in December 2014.

China’s steel and aluminum exports were up to 7.5 percent in comparison with 451,000 tons in April and up to 12.8 percent compared with 430,000 tons in May 2017. Steel exports in May reached 6.88 million tons. It increased by 6.2% against 6.48 million tons in April but down by 1.4% on a year ago.

Many analysts offered positive signals:

According to Paul Adkins – CEO of AZ China Consulting Company, China’s aluminum exports figures are a good number especially in the context of increasing US import taxes.

This result may be due to higher London’s aluminum prices after the punishment of United States gave for Russian manufacturer-United Company Rusal, he noted. With this sanction, Rusal’s metal price added $ 2700 / tons. This is an opportunity for Chinese steel and aluminum exporters.

Last month, Washington reduces its tariffs on steel products from Vietnam originated from China, while Canada began a preliminary dumping investigation on steel imports from China, Korea and Vietnam.

Kevin Steel, an economic analyst said the number of steel exports raised as expected. That export quantity is still not very significant in comparison with old period. This demonstrates that domestic steel industry is still operating well. Profits of domestic steel mills are still quite high”, he said. This may be due to the recovery in overseas demand or partly because of the growth of domestic market.

According to Steel-technology